The Great Housing Paradox

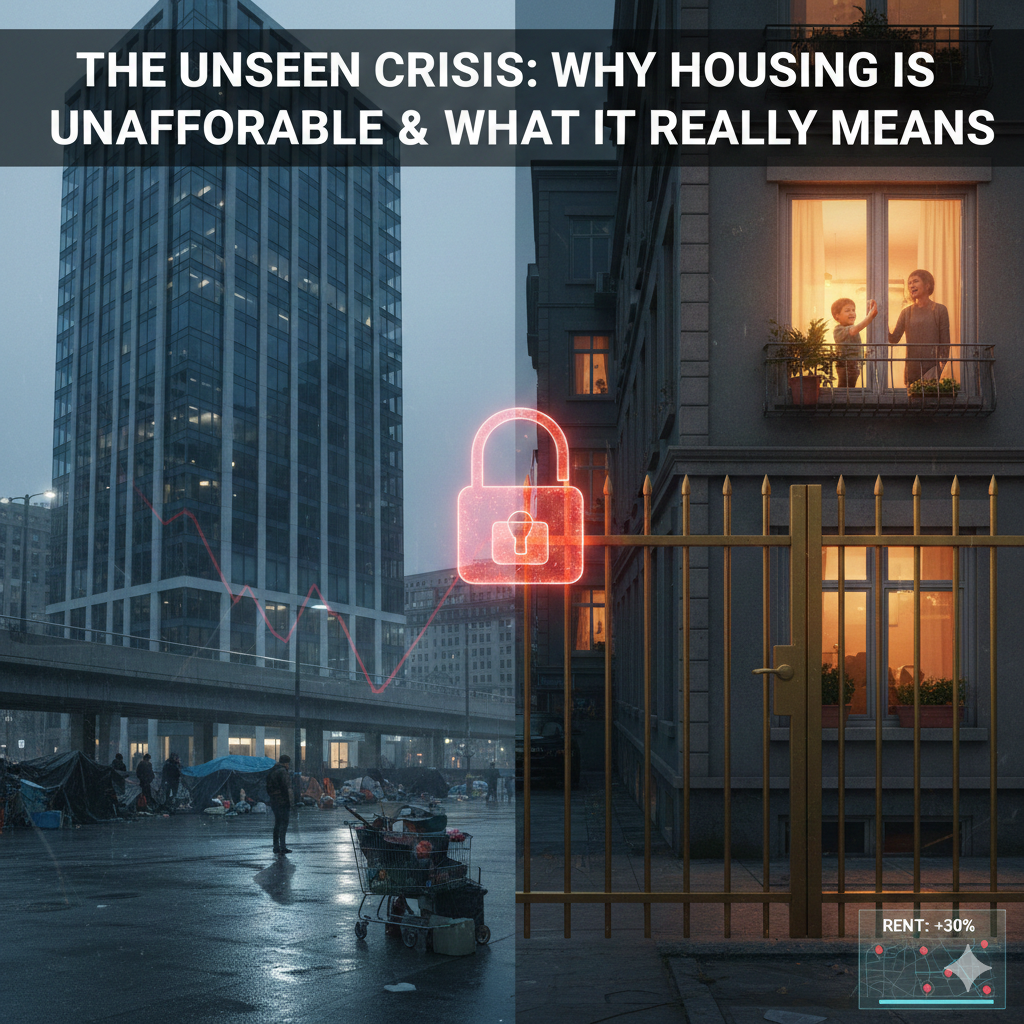

There is something deeply unsettling about driving past dark, glass-filled towers while people sleep in cars, tents, and shelters down the street.

Across the United States, millions of housing units sit empty at any given time, yet close to a million people have no where to live, and even more are struggling to afford their homes. This contradiction feels impossible on its face — if there are “enough” buildings, why are people still priced out?

The answer isn’t simple supply and demand. It’s the result of layered policy decisions, financial incentives, technological systems, and political influence that slowly reshaped housing from shelter into a speculative asset.

Why Housing Costs Keep Rising (And It Isn’t Just “Demand”)

For decades, U.S. cities have underbuilt the types of housing most people actually need. Local zoning laws in many metro areas still make it illegal to build multi-family housing in large residential zones. Duplexes, small apartment buildings, and townhouses were slowly pushed out by design rather than accident.

Community opposition — often labeled “Not In My Backyard” politics — has also stalled dense housing projects in the very places people want and need to live.

Even when developers are willing to build more affordable units, land prices, labor shortages, and material costs make those projects financially difficult without subsidies.

Meanwhile, wages have failed to keep up. According to the National Low Income Housing Coalition, a full-time minimum wage worker cannot afford a modest two-bedroom apartment anywhere in the U.S.:

https://nlihc.org/oor

Housing costs didn’t just rise. They disconnected from income.

Why Empty Offices Aren’t a Magic Fix

After the pandemic, the idea of converting vacant office buildings into apartments exploded in popularity. It sounds ideal. In practice, it’s extremely difficult.

Office towers weren’t designed for residential light, plumbing, or ventilation. Floor plates are deep, window access is limited, and full plumbing retrofits are enormously expensive. Many business districts also prohibit housing through zoning laws.

Conversions can help in limited cases, but they cannot solve the national housing shortage at scale.

Background on conversion challenges:

https://www.urban.org/urban-wire/two-obstacles-office-residential-conversions

Homelessness and the Debt Trap

The housing crisis isn’t just financial — it’s human.

According to the U.S. Department of Housing and Urban Development (HUD), about 771,480 people experienced homelessness on a single night in January 2024, an 18% increase from the year before:

https://www.hud.gov/press/press_releases_media_advisories/hud_no_24_005

Housing costs are also driving deep financial instability. Millions of renters are considered “cost-burdened,” spending more than 30% of their income just to stay housed.

Meanwhile, total U.S. household debt surpassed $17.3 trillion, according to the Federal Reserve Bank of New York:

https://www.newyorkfed.org/newsevents/news/research/2023/20231107

When housing absorbs most of a paycheck, everything else becomes fragile.

How Technology Quietly Rewired the Housing Market

Housing today is shaped by software as much as by landlords.

Platforms like Zillow (https://www.zillow.com) and Redfin (https://www.redfin.com) brought pricing transparency — but they also accelerated market speed and speculation.

iBuyers such as Opendoor (https://www.opendoor.com) use algorithms to buy and resell homes at scale, turning ordinary houses into short-term financial instruments.

One of the most controversial players is RealPage. The company provides algorithmic rent-setting software used by large landlords across the country. Investigations from ProPublica suggest these systems may encourage coordinated rent increases and reduce real market competition:

https://www.propublica.org/article/realpage-rent-pricing-algorithm

The Quiet Power of Real Estate Lobbying

Much of U.S. housing policy is shaped behind closed doors.

The National Association of Realtors is one of the most powerful lobbying forces in the country, spending tens of millions of dollars per year. Their lobbying history is tracked by OpenSecrets:

https://www.opensecrets.org/orgs/national-association-of-realtors/summary?id=D000000062

Their advocacy often protects existing industry structures and resists reforms — including zoning changes — that might soften prices but disrupt profits.

What This Actually Tells Us

The housing crisis is not accidental. It’s the predictable outcome of decades of decisions:

Housing treated as an investment instead of infrastructure

Policy designed to protect property values over access

Algorithms trained for profit, not fairness

Lobbying that favors industry stability over public need

This is how a country ends up with empty buildings and full shelters.

Realistic Paths Forward (Without Fantasy Fixes)

There is no single fix. But there are grounded, evidence-based shifts that could change the trajectory:

Zoning reform to allow more natural density

Serious public investment in affordable housing

“Housing First” homelessness strategies

Regulation of algorithmic rent setting systems

Expansion of community land trusts

When housing becomes infrastructure again, stability follows.

Until then, this paradox isn’t going away.

Want to understand more about world events? Check out the world event section of Interconnected Earth.